Overview

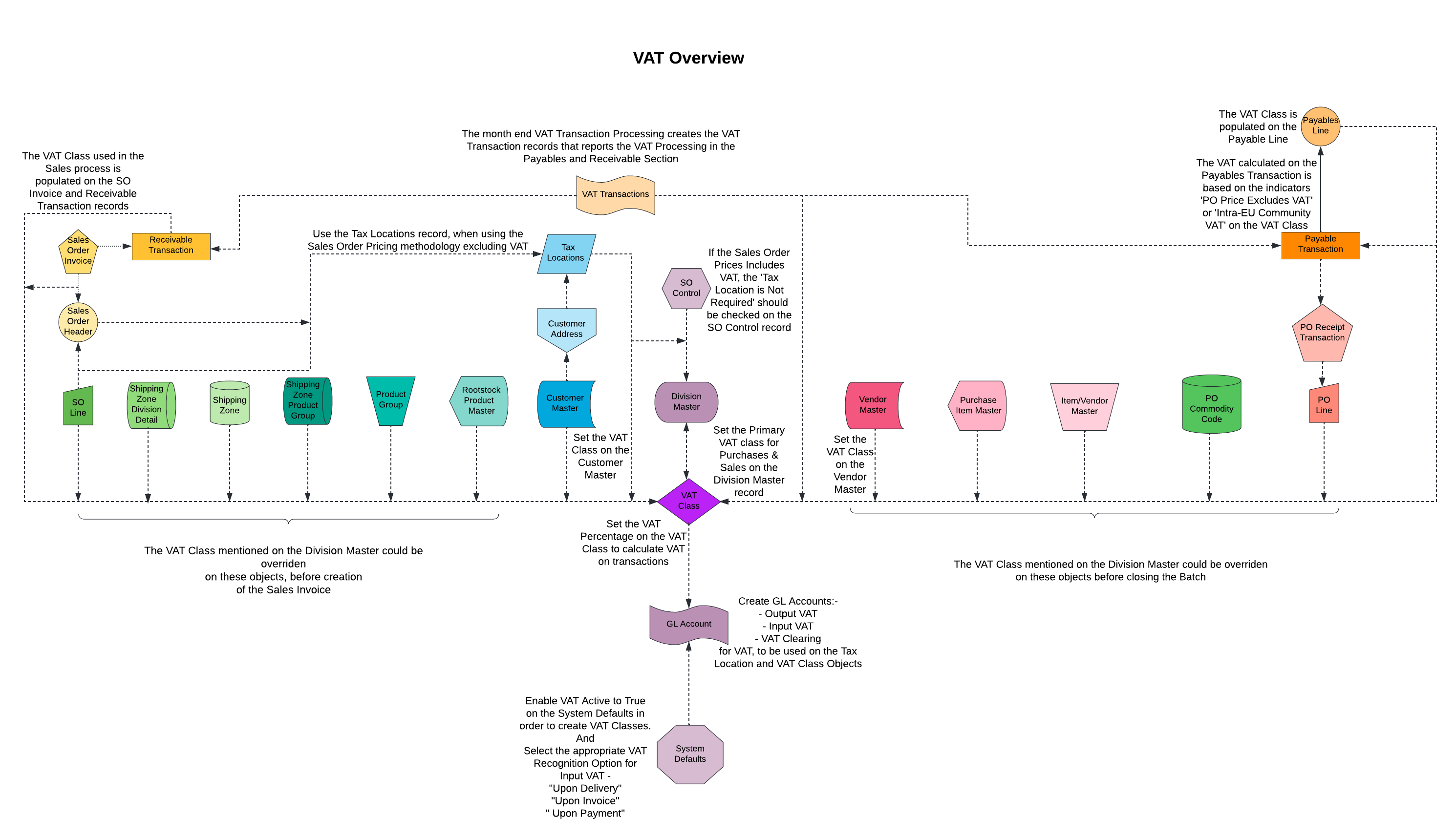

Value Added Tax (VAT) is a consumption tax placed on the value added to goods or services at different steps in the supply chain. Not all companies are required to collect and remit VAT. Seek the advice of a qualified tax professional to decide if your company needs to collect and report VAT. Similar to the Sales Tax functionality that has been a part of Rootstock Sales Order processing since its inception, the Rootstock product now allows users to define Tax Locations & VAT Classes which are used in both the Sales and Purchasing processes to record Value Added Tax liabilities.

Prerequisites

VAT functionality must be activated for use in the Rootstock Software. There are various points at which the VAT class can be set for use in the Purchase Order and Sales Order process. These points and setup steps are documented in Value Added Tax (VAT) Setup Requirements

The following should be considered when a user is preparing Rootstock for VAT:

-

Will Purchase Order Prices be quoted Excluding or Including VAT?

-

Will Sales Order Prices be quoted Excluding or Including VAT?

-

At what point will VAT be recognized (see Value Added Tax (VAT) - Recognition Option)? In various VAT jurisdictions, VAT may be recognized at a different point in the transaction life cycle. For example, in one jurisdiction, it may be recognized upon receipt of the goods / services, yet in another jurisdiction, it may be recognized only upon the Invoice Date. Rootstock allows a user to set the recognition option in System Defaults

-

Is there any VAT apportionment? In certain jurisdictions, the full VAT amount on purchases may not be claimed when a company has both Sales that are subject to VAT or VAT exempt. In some countries where this is the case, the VAT claimed on purchases may only be claimed in the proportion of Sales subject to VAT as a % of Total Company Sales. VAT apportionment is set in Value Added Tax (VAT) Class.

Processing

Once the user has correctly configured the VAT setup, VAT will be applicable in the following transactions:

-

Procure to Pay cycle - from Purchase Order to Payable Transactions

-

Non-Purchase-Order Payable Transactions (Manual AP Invoice, Vendor Debit & Vendor Credit)

-

Order to Cash Cycle - from Sales Order to Receivable Transactions

-

Non-Sales-Order Receivable transactions (Debit Memo & Credit Memo)

The processing of the above transactions is more clearly described in below articles:

The month-end VAT reporting and analysis is described in Value Added Tax (VAT) - Month End Processing.

Click on the image to enlarge. It contains hyperlinks to related articles.

Table of Contents

-

Context Articles

-

Setup Articles

-

Application of VAT Articles