Overview

The Cash Receipts function:

-

Allows the entry of bank deposits and the application of cash to open AR Invoices and Debit Memos.

-

Permits the entry of unbilled cash receipts and Unapplied Cash Receipt Transactions (cash that will eventually be applied to open AR Invoices and Debit Memos, but which can’t be applied at the time of receipt).

-

Allows open Credit Memos and previously entered Unapplied Cash Receipt Transactions to be applied to open AR Invoices and Debit Memos.

-

Permits individual open AR items to be written up or down (subject to limits set on the AR Control record on the Write-Offs tab).

For companies that have not checked the "Multiple Transactions per Session" box on the AR Control screen, the program allows posting at the time of entry or after review. Companies that have checked the “Multiple Transactions per Session” box on the AR Control screen will post Cash Receipts transactions from the Cash Receipts Journal program.

This program should be used when there are multiple customer payments grouped into a single bank deposit. It is recommended that the Quick Cash Receipts program is used when entering single customer payments as single bank deposits.

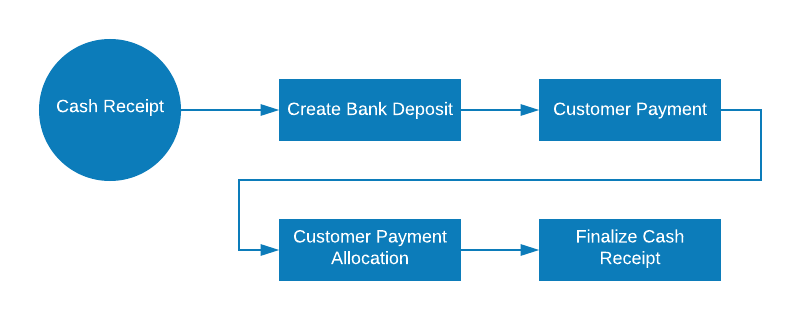

Process Work Flow

Click on the image to enlarge. It contains hyperlinks to related articles.

Navigation

Accounts Receivable > Cash Receipts

Processing

The Cash Receipt can be performed by following the below steps:

-

Create Bank Deposit: Create and edit a bank deposit.

-

Capture Customer Payment: Associate / Add a Customer Payment to the bank deposit.

-

Customer Payment Allocation: Apply a Customer Payment to open Customer transactions.

-

Finalize Cash Receipt: Check the processed amount and change the status of the deposit.

SEE ALSO