Overview

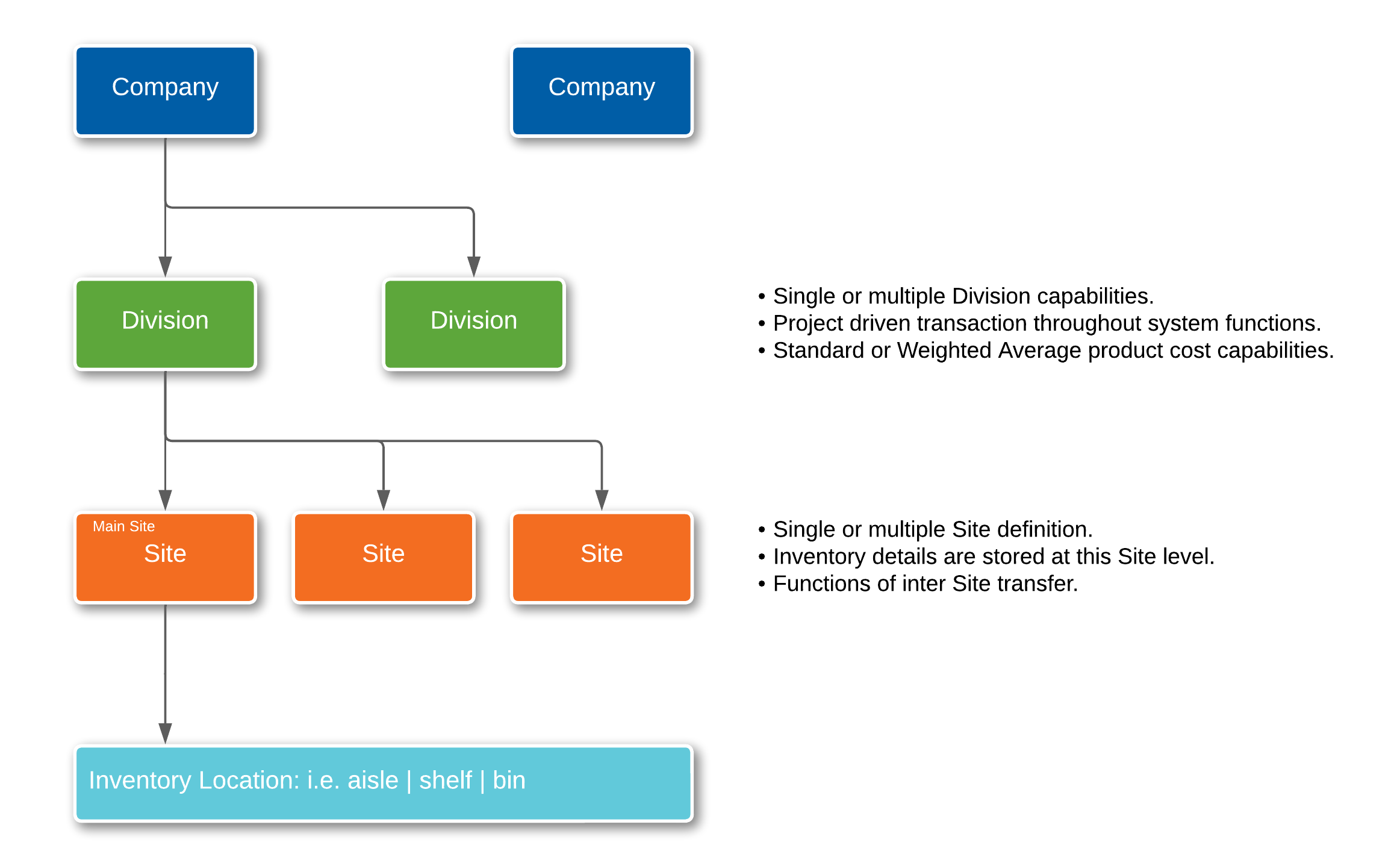

A Rootstock Company is the 'legal entity' for the business unit. It is the business unit that defines the Financial Reporting (P&L, Balance Sheet) for each Division. Depending upon the organizational structure of the business, the Company must contain one or more Divisions (business units, e.g., manufacturing plants).

NOTE More than one Rootstock Company can exist in a Salesforce Organization.

NOTE More than one Rootstock Company can exist in a Salesforce Organization.

Options exist within the system to build a hierarchy between organizational levels. These hierarchical relationships include options (system behavior, restrictions, etc.) established at the Parent Level that influence controls (system behavior/restrictions, etc.) at the Child Level. These controls are based on a Company’s operational strategy. The Parent Level control setting influencing the Child Level control setting ensures the same approach will apply throughout the Company. Some of these controls are established at the Company Master level.

The Company Master is the highest-level identifier within the Organization and is the entity responsible for an Organization’s profit and loss. Customers, Vendors, and Financials are maintained at the Company level.

Organizational Structure

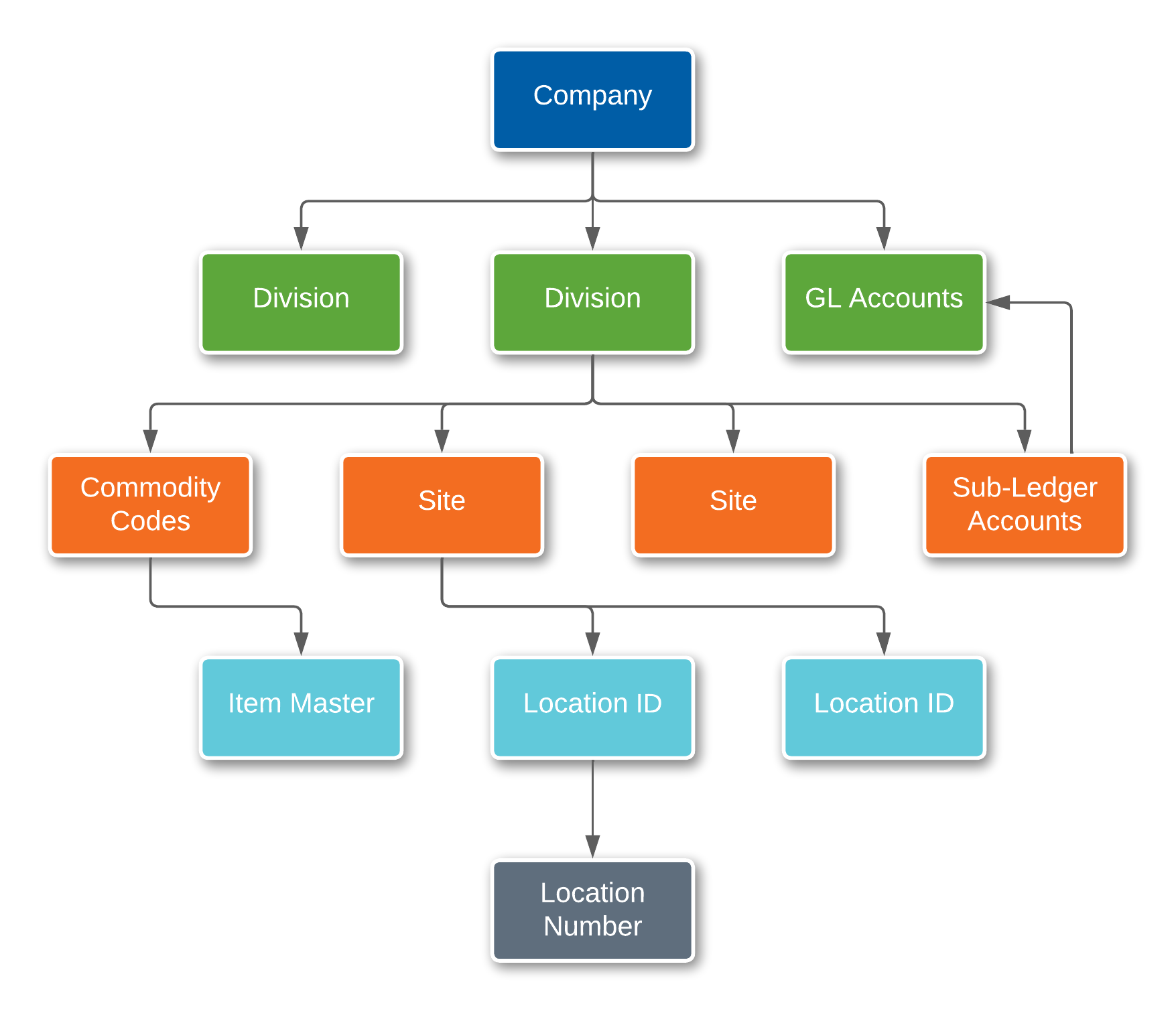

Decisions made at the Company level will determine the controls in related Divisions. In turn, the Divisions have control settings that influence Commodity Codes, which, in turn, influence settings on the Item Master.

Application

Within Rootstock, the Company is comprised of one or more Divisions. When there are multiple Divisions, there may be centralized functions for Engineering, Purchasing, and Sales. If there is a Centralized Engineering Division, it will be identified at the Company level. Similarly, in a Multi-Divisional environment, the user can specify the Centralized Buying Division and/or the Centralized Sales Division at the Company level.

Navigation

Company Master

Processing

Navigate to the List View of all existing Company Master records. From here, the user may edit existing records or create a new Company Master.

Fields

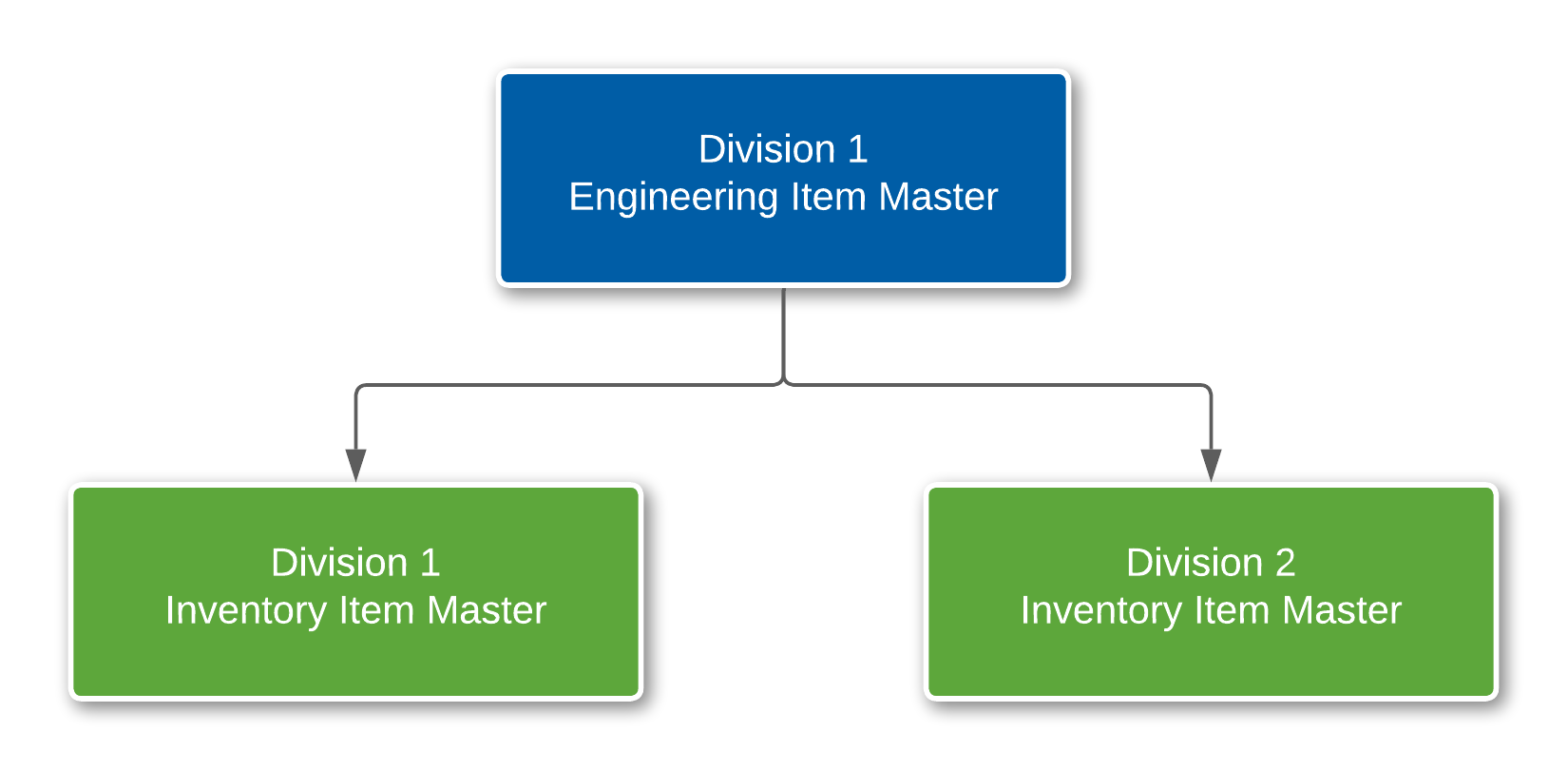

Centralized Engineering Indicator: If Centralized Engineering is used, one Division must be designated as the Engineering Division. The designated Engineering Division is the only Division where users can create and maintain Engineering Item Masters, BOM’s, and Revisions. In this scenario, one Division is the Engineering Division, and any other Divisions are Inventory Divisions. Without Centralized Engineering, the Engineering functions can be completed in any Division.

The decision to use Centralized Engineering is final. Once the designation is made, it cannot be changed. Centralized Engineering creates a one-to-many relationship between the Engineering Item Master (maintained by the Engineering Division) and the Division-specific Inventory Item Masters. Therefore, the Items created by the Engineering Division may be defined in one or more Divisions designated as Inventory Divisions.

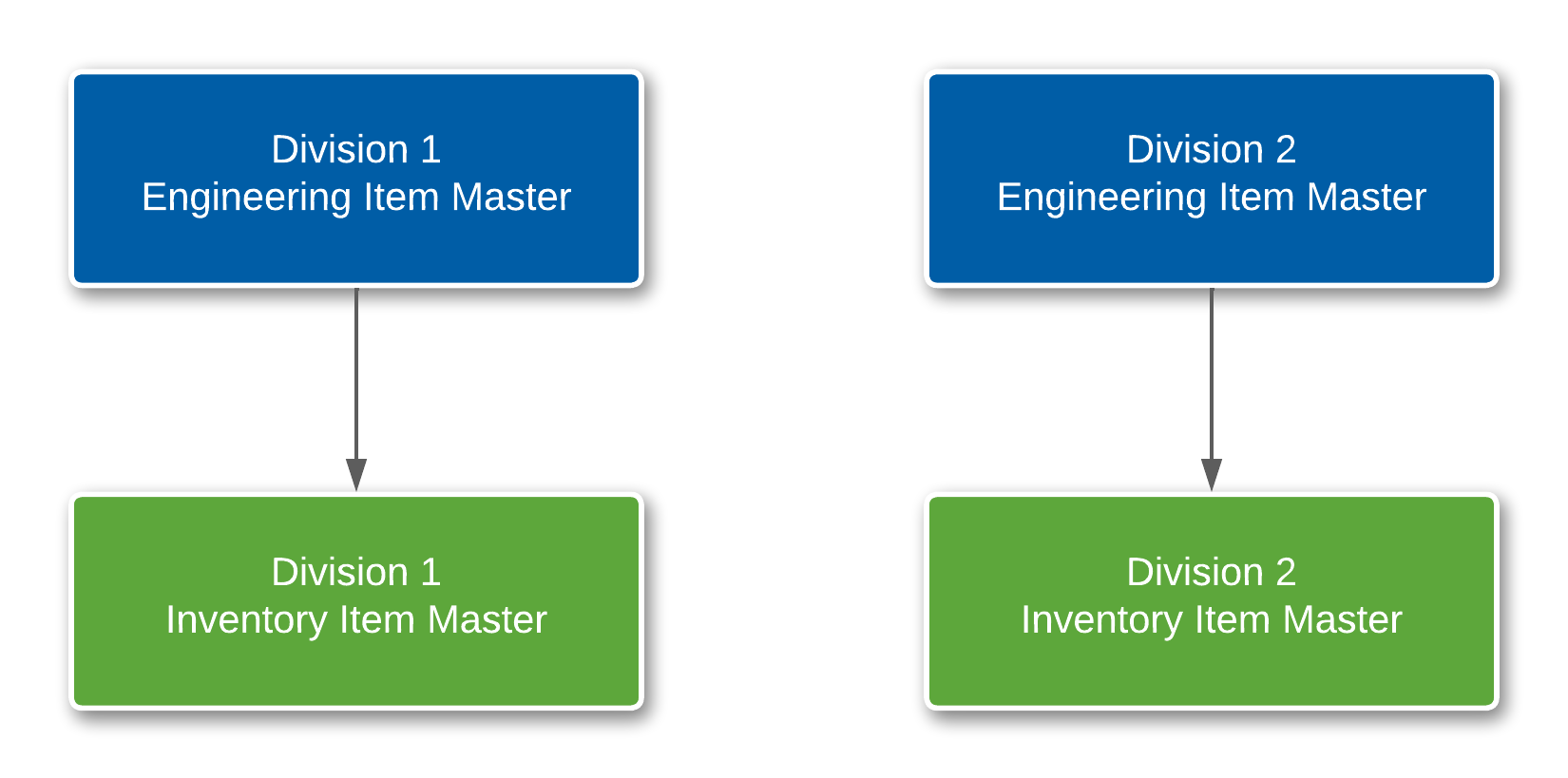

Under Non-Centralized Engineering, each Division maintains an Engineering Item Master and Inventory Item Master for each Item independent of other Divisions. So, using Non-Centralized Engineering results in a one-to-one relationship between the Engineering Item Master (Division-specific) and Inventory Item Master (Division-specific).

Engineering Division: This must be selected from the pre-defined dropdown values. Once selected and saved, it cannot be changed.

Mfg Accounting Division: This must be selected from the pre-defined dropdown values.

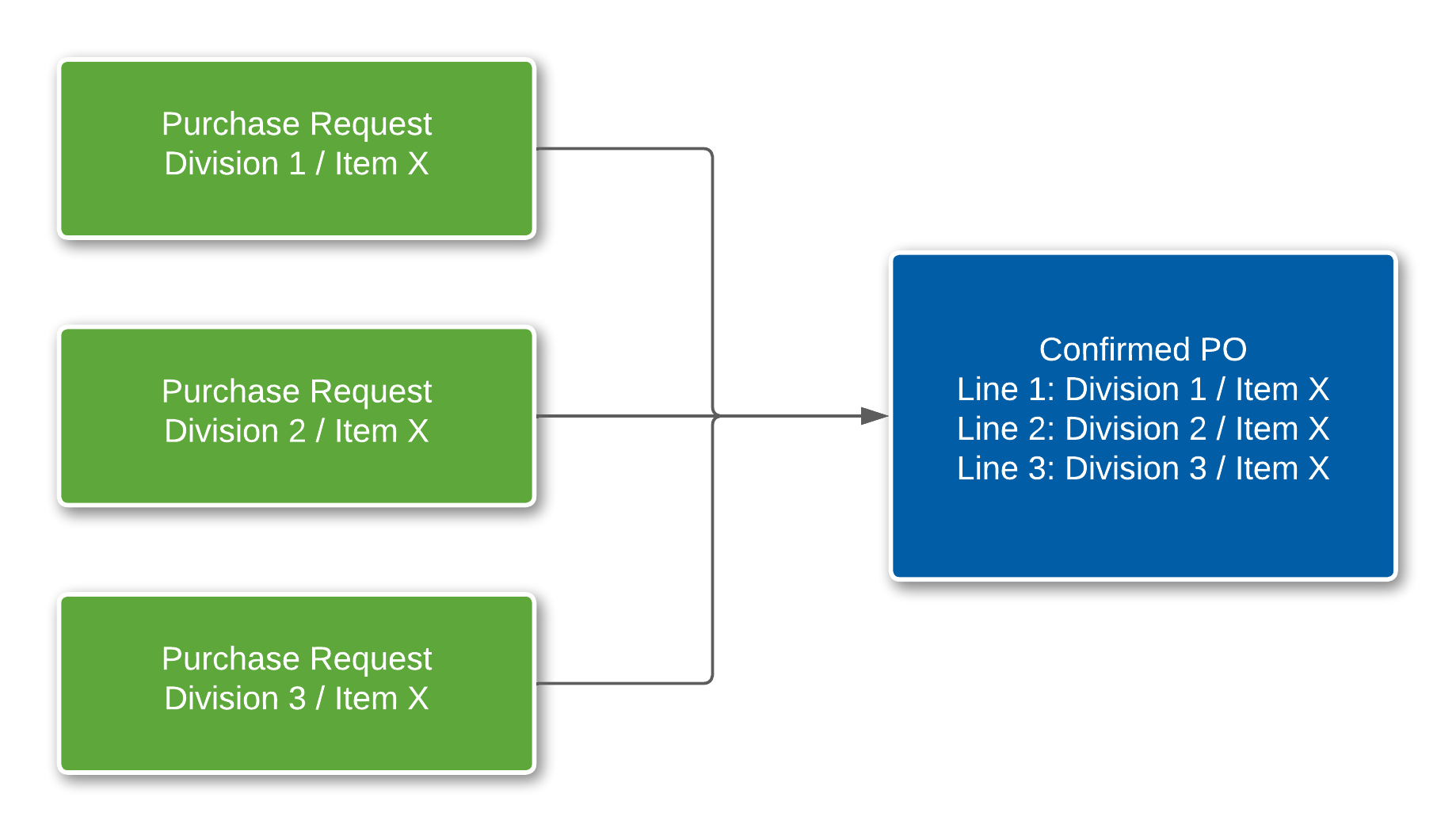

Centralized Buying Division: Under Centralized Buying, one Division is designated to create Purchase Orders for all Divisions. This control does not stop each Division from manually creating and placing Purchase Orders. Centralized Buying Control provides the means to consolidate multiple delivery lines for the same Item (where each delivery line has a different Division and destination-Division Delivery Address) within one Purchase Order. It cannot be changed once the Centralized Buying Division field is set and saved.

Centralized Sales Division: Under Centralized Sales, a single Division is designated to create Sales Orders for all Divisions. This control does not, however, prevent each Division from creating Sales Orders. Centralized Sales Control provides the means to consolidate multiple Shipment Lines for the same Item where each Shipment Line represents demand from a different Division under one Sales Order. It cannot be changed once the Centralized Sales Division field is set and saved.

UTC Offset: Used to set the Accounting Date on the Cost Transaction record based on UTC/GMT offset. Setting the value to 0 will result in the Accounting Date being equal to the Cost Transaction Date.

Currency Exchange Rate Source: This can be selected from the three pre-defined dropdown values.

Home Currency: This field defines the Company’s Home Currency.

Accounting Company Reference: If an Accounting System is used, this is the reference to the associated Accounting System Company.

Logo Scale Option: Allows the user to scale their Company Logo in Print/Email Templates by either height or width. If the Logo is wider than higher, the width option would be chosen, and vice-versa.

Company Logo for External and Internal Documents: These two fields provide the Company Logo location for internal and external documents.

Custom Field Tab Name: The default tab name is used when creating custom tabs.

Detail Section of Screen - Tabs

Accounting Tab

FIFO Cost Method Active: The decision to use FIFO (First-In-First-Out) Costing for Inventory transactions is established at the Company level. FIFO Cost for Purchased Items is only available in a Weighted Average Cost Division. It is available only for Purchased Items. For Items designated as FIFO Controlled, upon the issue, goods are transacted at a cost based on First In First Out Inventory. Costs of FIFO Items are held at the cost incurred upon PO Receipt.

NOTE This field 'FIFO Cost Method Active' will be disabled if the 'Centralized Engineering Indicator' is checked and there is any Division Master that belongs to this Company using the Standard Cost Method.

NOTE This field 'FIFO Cost Method Active' will be disabled if the 'Centralized Engineering Indicator' is checked and there is any Division Master that belongs to this Company using the Standard Cost Method.

NOTE To learn more about Cost Methods available in Rootstock ERP, refer to the Cost Accounting Overview/Guide.

NOTE To learn more about Cost Methods available in Rootstock ERP, refer to the Cost Accounting Overview/Guide.

Account, Div to Div Clearing: This is the Sub-Ledger Account through which Division-to-Division Transfers are cleared. There is a credit to Inventory and a debit to this Account for the from Division and a credit to this Account and a debit to Inventory for the to Division.

Account, Accrued AP: This is the Sub-Ledger Account credited on a PO Receipt and debited on a Receipt Reversal or RTV.

Account, PO Invoice Price Var: When there is a difference between the PO Receipt Unit Price and the Invoice Unit Price (or the Unit Price that Accounts Payable is authorized to pay), the debit or credit is charged to this Sub-Ledger Account.

Account, Invoice Receipt Qty Var: When there is a difference between the PO Receipt Quantity and the Invoice Quantity (or that quantity that Accounts Payable is authorized to pay), then the debit or credit is charged to this Sub-Ledger Account.

Account, Receipt Exchange Rate Variance: This is the Account to which Exchange Rate Variances on Receipts will be charged.

Bypass AP/AR for Intra-Company Txns: When checked, Inter-Division Financial transactions (buy-sell) will not debit/credit AP/AR Accounts.

Intra-Company COGS to Div-Div Clearing: When checked, Intra-Company COGS Division-to-Division Transfers are enabled, and the 'Account, Div to Div Clearing' will be used when creating the Shipper Line.

NOTE This 'Intra-Company COGS to Div-Div Clearing' flag can be checked when the flag 'Bypass AP/AR for Intra-Company Txns' is checked.

NOTE This 'Intra-Company COGS to Div-Div Clearing' flag can be checked when the flag 'Bypass AP/AR for Intra-Company Txns' is checked.

JPY No Decimals Feature Active: This field activates a feature that causes all monetary transaction values for this Company flowing from Operations (ERP) to Financials to be rounded to integers.

NOTE This 'JPY No Decimals Feature Active' flag can be checked when the flag 'JPY No Decimals Feature Enabled' on System Configuration is checked. When this flag is unchecked, the JPY No Decimals Rounding Method on the downstream records (SO Control and PO Control) will be set to blank.

NOTE This 'JPY No Decimals Feature Active' flag can be checked when the flag 'JPY No Decimals Feature Enabled' on System Configuration is checked. When this flag is unchecked, the JPY No Decimals Rounding Method on the downstream records (SO Control and PO Control) will be set to blank.

JPY No Decimals Rounding Method: This field carries the rounding method for monetary transactions under this Company. The options are:

NOTE This 'JPY No Decimals Rounding Method' must be specified when the flag 'JPY No Decimals Feature Active' is checked.

NOTE This 'JPY No Decimals Rounding Method' must be specified when the flag 'JPY No Decimals Feature Active' is checked.

Bypass Inter-Company Like Intra-Company: When checked, this feature causes Inter-Company Sales and Purchase Orders to be treated like Intra-Company Orders, bypassing AP and AR and redirecting COGS (all per Intra-Company settings).

Suppress Cost Transaction Postings to GL: When checked, this option suppresses the creation of GL Transactions (GLTXN) from Operation Transactions (SYTXNCST).

NOTE This 'Suppress Cost Transaction Postings to GL' flag can be checked only when the field 'Enable Option to Suppress ERP Postings' on the System Configuration is True.

NOTE This 'Suppress Cost Transaction Postings to GL' flag can be checked only when the field 'Enable Option to Suppress ERP Postings' on the System Configuration is True.

Variance Account Override: When checked, the PO-AP Match related transactions can be booked to the Inventory / Expense Accounts instead of the Variance Accounts. Also, the user can specify Inventory Accounts as Variance Accounts on the Inventory Commodity Code and Inventory Item Master.

Accrued AP Account Override: When checked, this field enables a feature where PO-AP Match related transactions normally booked to the Accrued AP Account are instead booked to the Inventory/Expense Account.

Financial Interface Tab

If Quickbooks is used as the Financial Interface, check the ‘QuickBooks Primary Company’ checkbox and enter the appropriate information. Otherwise, this tab is not used.

Dimensions Tab

Key Concept and Use

Various accounting software packages use Dimensions to track financial information by using sub-categories (Dimensions) to extend the General Ledger Chart of Accounts. This allows each Company to tailor the Dimension definition and structure to accommodate their specific needs without the need to greatly expand the Sub-Ledger or GL. Individual transactions within the ERP system are stamped with the GL Account Number and other values stored in the Dimension fields. The values are posted to the GL for use in Financial Reporting.

Considerations:

-

Dimensions are not allowed in a Quickbooks interface.

-

Dimensions are text values that are associated with Rootstock Cost Transactions.

-

The Rootstock application accommodates up to 8 Dimensions. FinancialForce Accounting only supports 4 Dimensions. When using FinancialForce, more than 4 Dimensions can be used in Rootstock by using Dimension Source Overrides. This allows a given dimension value to be transaction-specific.

-

Dimension control is at the Company level. Here, the number of Dimensions being used and the standard 'Source Entity' for each Dimension is defined.

NOTE If the flag 'Suppress Dimension Details' on the Company Master is checked, Dimensions are not in use for the Company. Also, Dimension Values will not be created under Purchase Order Line, Payables Distribution, Sales Order Line, Sales Invoice Line, Sales Order RMA Detail, Work Order Header, Dimension Routine, and Cost Transaction.

NOTE If the flag 'Suppress Dimension Details' on the Company Master is checked, Dimensions are not in use for the Company. Also, Dimension Values will not be created under Purchase Order Line, Payables Distribution, Sales Order Line, Sales Invoice Line, Sales Order RMA Detail, Work Order Header, Dimension Routine, and Cost Transaction.

-

A table containing valid values for each Dimension is maintained within Rootstock. When using FinancialForce Accounting, the Dimension Value must be created first in FinancialForce. The Dimension Name and reporting code in FinancialForce must be identical and match the Rootstock value.

-

The Dimension Values can originate from the following Rootstock 'Entities' (Sources).

-

Division

-

Project

-

Organizational Department

-

Inventory Item (which defaults to its Commodity Code)

-

Purchase Item (which defaults to its Commodity Code)

-

Sales Product (which defaults to its Product Group)

-

Customer

-

Manufacturing & Engineering Department

-

If the number of Dimensions is reduced on the Company Master setup, the system will clear the specified Dimension Source Values greater than the new set number of dimensions.

EXAMPLE When the number of Dimensions is lowered from 4 to 2, Dimension Source fields 3 and 4 will become blank.

EXAMPLE When the number of Dimensions is lowered from 4 to 2, Dimension Source fields 3 and 4 will become blank.

-

Dimension Values are assigned to each source entity in their respective maintenance programs (Division maintenance, Item maintenance, etc.). They are associated with the order records (e.g., Purchase Order, Sales Order, Work Order) and are then stamped on the Cost Transaction records.

-

System-generated transactions that stamp Dimension Values on Rootstock Cost Transactions (and to FinancialForce Accounting Journal Entries) include:

-

Work Order (Component Issue, Work Order Receipt)

-

Sales Order (Sale and Cost of Sales transactions, etc.)

-

Purchase Order (PO Receipt, RTV, scrap, Sub-Contract Processing, etc.)

-

Machine and Labor Bookings

-

Miscellaneous Inventory transactions (not associated with an 'order'), such as stock adjustments from Cycle Counts.

-

The user can also override the source entity for any Dimension on any of the five Transaction Types noted above. This is accomplished by using Dimension Source Override in the setup menu.

-

Because transactions within Rootstock originate from different functional areas of the system, not all entities are available for all transactions. For example, there is no Customer associated with a Purchase Order transaction.

-

Entities common to all transactions are Division, Project, and Organizational Departments.

-

Below are the entities that are available for each transaction. When setting up the Dimensional structure, it is important to understand and consider where the various transactions are coming from and how the Dimension Values can and will be implemented:

-

The Dimensions tab allows the user to set the number of Dimensions for a Company. Each Dimension must be associated with a Source for that Dimension, as described above.

SEE ALSO

Division Master

Site Master

Organizational Departments