Overview

This program is used to access a list view of existing Journal Entries and create new Journal Entries. It is an alternative to the Journal Entry Workbench.

Background Information

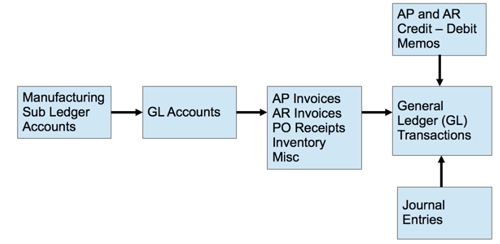

Financial transactions other than those originating in AP, AR, and Inventory flows are entered as Journal Entries and are posted to General Ledger when they are finished and approved.

Process Work Flow

Navigation

Lightning: Journal Entry Headers.

Classic: Rootstock Site Map > General Ledger > Journal Entries.

When this menu item is selected, a list of existing Journal Entries is displayed.

Create Journal Entry Header

Journal Date, Entry Description, and Person Responsible are mandatory fields. Use the Standard ID (Std ID) to tag Journal Entries with existing Journal Entries templates. Please refer to the article Journal Entry Templates for further details. Here the user can also indicate if an entry is a Year End Adjustment Entry or a Reversing Entry. The Reversal check box indicates whether the current entry serves as a reversal for another JE Reversed provides a link to that original Journal Entry.

The user can create new Journal Entries by entering the Journal Entry header information first, and then the user can create the Journal Entry lines.

Fields

Company: The Financial Company to which this Journal Entry applies.

Journal Date: Enter the date when adding a new Journal Entry, which will set the Fiscal Year and Period into which that date falls based on the Fiscal Year object.

Year: The Fiscal Year, driven by the Journal Date entered, that this Journal Entry falls within.

Period: The Period within the given Fiscal Year, driven by the Journal Date entered, that this Journal Entry falls within.

NOTE

NOTE The period ranges from 1 to 12 if '

Use 13 Operational Periods' is set to False in

System Configuration (SYCONFIG), or from 1 to 13 if it is set to True.

JE Reference Number: Optional, user-defined numeric (whole number) identifier up to 10 characters in length.

NOTE

NOTE When the Journal Entry is reversed, this '

JE Reference Number' is referenced in the same field on the reversed Journal Entry.

Originating Template: Optional; select the pre-defined Originating Template.

Std ID: Select the pre-defined Standard ID if using the Standard ID option.

Entry Description: User-defined description for this Journal Entry; can be up to 255 characters in length.

Opening Balance Entries (Period Zero): When checked, indicates that the entries in this Journal Entry Header are to be posted as Opening Balances to Period 'zero' (The Fiscal Year is derived from the Journal Date).

Year End Adjustment Entry: When checked, this Journal Entry will be 'booked' to Period 13 of the given Fiscal Year. Note that the Period must be closed for posting and open for Adjustments.

NOTE The user can set this flag 'Year End Adjustment Entry' to True only if the flag 'Year-End Adjustment Period is Open' in the corresponding Fiscal Year record is set as True.

NOTE The user can set this flag 'Year End Adjustment Entry' to True only if the flag 'Year-End Adjustment Period is Open' in the corresponding Fiscal Year record is set as True.

Reversing Entry: When checked, it indicates this is a Reversing Entry.

NOTE When creating a Journal Entry with this flag 'Reversing Entry' set to True, the reversal entry will be created based on the flag 'Use 13 Operational Periods' in System Configuration (SYCONFIG):

NOTE When creating a Journal Entry with this flag 'Reversing Entry' set to True, the reversal entry will be created based on the flag 'Use 13 Operational Periods' in System Configuration (SYCONFIG):

-

-

-

- If it is True and the 'Period' is 12, the reversal entry will be created in Period 13.

- If it is True and the 'Period' is 13, the reversal entry will be created in Period 1 of the next year.

- If it is False and the 'Period' is 12, the reversal entry will be created in Period 1 of the next year.

NOTE The flags 'Opening Balance Entries (Period Zero)', 'Year End Adjustment Entry', and 'Reversing Entry' are mutually exclusive, only one can be set at a time.

NOTE The flags 'Opening Balance Entries (Period Zero)', 'Year End Adjustment Entry', and 'Reversing Entry' are mutually exclusive, only one can be set at a time.

Person Responsible: The Financial System User responsible for this Journal Entry.

Status: Current status of the Journal Entry. When created, it starts as 'Incomplete.' Once the Journal Entry is complete & in balance (use the 'Test Entry' function to verify), the status changes to 'Ready to Post.' Once posted using the 'Post Entry' button, sets to 'Posted'.

Alternate Maintenance Currency: This field carries the currency in which the details were entered when the entry (Maintenance) currency is other than the company's Home Currency.

NOTE The value of this field 'Alternate Maintenance Currency' cannot be changed if the Max Line No value is greater than zero.

NOTE The value of this field 'Alternate Maintenance Currency' cannot be changed if the Max Line No value is greater than zero.

NOTE If the 'Originating Template' is selected, this field defaults from the 'Alternate Maintenance Currency' on the selected Journal Entry Templates. And the user cannot change this value.

NOTE If the 'Originating Template' is selected, this field defaults from the 'Alternate Maintenance Currency' on the selected Journal Entry Templates. And the user cannot change this value.

Exchange Rate: This field carries the Exchange Rate used to convert the Maintenance (Entry) Currency to the Home Currency. It is applicable only when a currency other than the Home Currency is used.

NOTE Exchange Rate must be greater than zero if the Alternate Maintenance Currency has any value. And the Exchange Rate value cannot be changed if the status is ‘Ready to Post’ or ‘Posted’.

NOTE Exchange Rate must be greater than zero if the Alternate Maintenance Currency has any value. And the Exchange Rate value cannot be changed if the status is ‘Ready to Post’ or ‘Posted’.

Create Journal Entry Lines

Next, select the JE Detail Maintenance button to create Journal Entry Lines by entering the GL Accounts, Debit/Credit Amounts, Divisions, Projects, VAT Class, comment, Payable Invoice Number, Receivable Document Number, PO Number, SO Number, Order Line, Work Order Number, and RMA Number. If the Alternate Maintenance Currency field is not blank, instead of Debit/Credit Amounts, Debit/Credit Amount - Maintenance Currency must be used to create the Journal Entry Lines. Use the Add button to insert more Journal Entry Lines and use the Save button to save the records.

NOTE When 'Carry Comment Forward to Next Line' is checked and a new Journal Entry Line is inserted using Add button, then the 'Comment' defaults from the previous row.

NOTE When 'Carry Comment Forward to Next Line' is checked and a new Journal Entry Line is inserted using Add button, then the 'Comment' defaults from the previous row.

NOTE The 'GL Account' cannot be the same as the 'Prior Years’ Gain/Loss on Exchange Acct' on the Financial Company Master.

NOTE The 'GL Account' cannot be the same as the 'Prior Years’ Gain/Loss on Exchange Acct' on the Financial Company Master.

NOTE The user can add up to eight Dimensions Values for a single Journal Entry Line.

NOTE The user can add up to eight Dimensions Values for a single Journal Entry Line.

Test, Post, Delete, and Edit Journal Entries

After the Journal Entry Header and Lines have been created and saved, the Journal Entry is ready to be tested for completeness. Before it is posted, the Journal Entry needs to be tested for completeness by clicking the Test Entry button on the Journal Entry Header. Once the entry is known to be complete and in balance, the entry status has changed to 'Ready to Post,' and the Post Entry button is enabled on the Journal Entry Header.

To post the Journal Entry click the Post Entry button. After the entry posts to the general ledger, the entry status changes to 'Posted.'

For Journal Entry Header with more than 200 Journal Entry Details, the posting will happen in multiple transactions by breaking the Journal Entry Details into different posting groups. Each posting group has 200 entries, and the Posting Clearing Account (at the Financial Company Master) is used to force-balance subsets in each group.

IMPORTANT The user can post up to 2500 Journal Entry Details under a Journal Entry Header.

IMPORTANT The user can post up to 2500 Journal Entry Details under a Journal Entry Header.

EXAMPLE

EXAMPLE

-

Consider a Journal Entry Header having 300 Journal Entry Details.

-

Upon posting, the system will take the first 199 entries in a posting group and determine the total of the Debits and Credits in those entries. If the Debit total does not equal the Credit total, the system will create an additional '200th entry' using the Posting Clearing Account that forces the set to Balance and then posts that set.

-

The system then creates a second entry to the Posting Clearing Account that reverses the first entry and includes it when posting the remaining 101 Journal Entry Details in the second posting group (this will offset the first clearing entry and also bring the remaining Journal Entry Details into balance).

To edit the Journal Entry click the Edit button. To delete the Journal Entry click the Delete Entry button.

NOTE The Journal Entry can be deleted or edited until it is posted.

NOTE The Journal Entry can be deleted or edited until it is posted.

Clone Journal Entries

To clone the Journal Entry Header click the Clone JE Batch button. This will clone the Journal Entry Header along with its Details, set the 'Journal Date' as today's date, and 'Status' as 'Incomplete' on the cloned Journal Entry Header.

NOTE The system will not clone the JE Details with 'Posting Balance Transaction' as true.

NOTE The system will not clone the JE Details with 'Posting Balance Transaction' as true.

SEE ALSO

Print Journal Entries

Journal Entry Templates

Journal Workbench

General Ledger Overview